Freeflow Ventures, a venture capital firm specializing in science-driven solutions to human and planetary health challenges, has raised $50M in new funds, comprising a $35M Fund Two and a $15M Opportunity Fund. This brings Freeflow’s total assets under management to $90M, including previous investments from a $25M Fund One and $15M in SPVs. Despite a challenging venture capital market, Freeflow doubled its fundraising from its initial Fund One cycle to Fund Two.

In its latest investment move, Freeflow Ventures has entered the Berkeley deep tech startup ecosystem with an investment in Catena Bio. Originating from Caltech in Pasadena, where the firm has already made over 30 investments since 2020, including ventures by Nobel Laureates like Frances Arnold and David Baltimore, Freeflow expands its footprint to Berkeley. This expansion aims to leverage Berkeley’s rich scientific research community, known globally for its contributions to innovation.

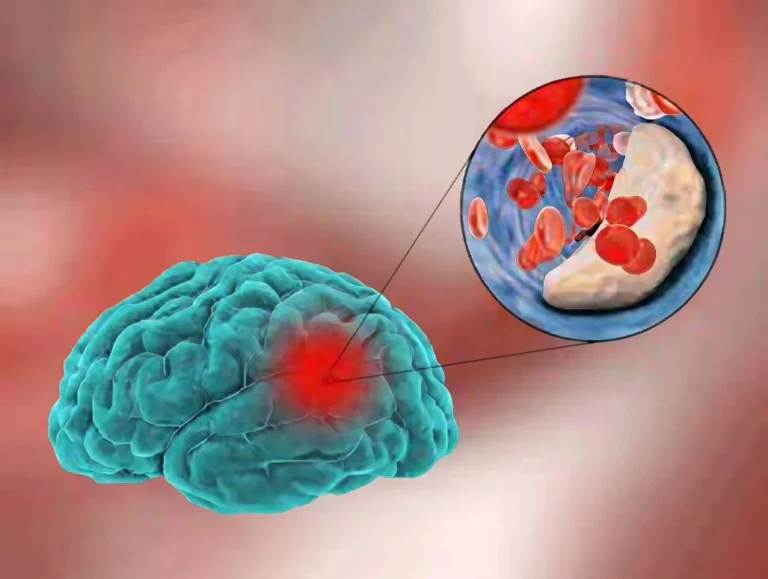

Catena Bio stands out in the field of Antibody Drug Conjugate (ADC) technology, pioneering a novel conjugation method that supports multiple payload capabilities for enhanced cancer treatment outcomes. Founded by CEO Marco Lobba, a former UC Berkeley PhD student under the guidance of Professor Matt Francis and Nobel Laureate Jennifer Doudna, Catena Bio operates within the Bakar BioEngenuity Hub at UC Berkeley.

David Fleck, founder and managing partner of Freeflow Ventures, expressed enthusiasm about the expansion: “This new funding enables us to extend our operational model to Berkeley, which shares significant parallels with Caltech and JPL. These communities align perfectly with our mission to support high-impact innovations in human and planetary health.”

Founded in 2019, Freeflow Ventures continues to foster groundbreaking science and computational innovations that scale sustainable solutions to global challenges.